5G Fibre Deployment: Economical, Fast, Flexible

Connected Britain 2018

Presented at Total Telecom Connected Britain conference, take a moment to read Mentor’s view of how the UK is progressing in its 5G deployment.

The UK is off the pace in the race to 5G.

Other countries are accelerating away – not because we don’t have drones or self-driving cars – but, more importantly, because one of 5G’s main building blocks, dark fibre, is in short supply.

Dark fibre is key for network densification – and densification is also crucial for 5G.

But we don’t have enough dark fibre. And the market that’s supposed to supply it – is backfiring.

Openreach has succeeded in shaking off Ofcom’s dark fibre obligations – but this error in judgement will soon see their role in mobile infrastructure start to circle around the drain – faster than anyone imagines.

But, there’s some good news too.

I’ll share with you some of the work we’ve been doing to unlock the 5G dark fibre infrastructure market – and much more besides.

Global Race for 5G

So, are we really falling behind?

At the Cellular Telecommunication Industry Association’s (CTIA) “Race to 5G” April conference – held in Washington DC – the main theme was “The race to lead the world in 5G is on – and America needs to win.

At stake? Millions of new jobs, billions in economic growth, and transformative advances across industries.”

What’s clear is the US sees their competitors – not as the UK or Europe – but Japan, China and Korea. Only a few weeks ago, the ICT ministers of these countries jointly agreed to collaborate on 5G technology.

This is a big reversal from the days of 2G and 3G, when the UK led the world. I’m sure many of us remember the US being a bit of a laggard in mobile.

Well, not anymore.

What can we learn from the US market about the role of dark fibre? And what would a good Dark Fibre market look like?

Two recent US examples highlight for me what a functioning Dark Fibre market looks like.

Zayo recently announced their plan to upgrade a US wireless operator’s “fibre to the tower network”. They’ll bring dark fibre facilities to over 1,800 cell sites in 26 markets.

When it’s finished, Zayo’s FTTT network will exceed 10,000 cell sites nationwide.

Crown Castle have their “Horizontal Towers” scheme. In January, they had 50,000 small cell nodes. And – for small cell backhaul – they currently own 60,000 route miles of fibre. Including 23 of the top 25 US markets.

They’ve been averaging 2.5 nodes – per mile of fibre. And, in the last year, they’ve put 5,000 nodes “on air” – with 30,000 more in the pipeline.

Even recognising population differences, the US numbers dwarf the small cells deployed in the UK so far.

The US has got down to business. Densification is clearly not a problem there.

Here, in the UK, we have seen a few trials announced – adding up to a few hundred small cells. Compared with the US and elsewhere, 5G is stalled.

We’re being half-hearted about it!

UK 5G story so far

But, the news is not all bad.

The latest 5G spectrum auction is complete.

The latest 5G spectrum auction is complete.

Vital spectrum is now in the right hands – and the lop-sided distribution of spectrum across UK operators has been reduced – just a little.

But, Three’s words of warning about capping BT – before the auction – now seem prophetic, don’t they?

The auction process bled £1.4Bn of cash from the UK mobile networks – which won’t encourage rapid network investment. Quite the reverse.

It looks like an age-old tax grab. And, in the absence of any rollout obligations, it’s not good news for UK 5G.

We estimate the UK Government’s 5G innovation fund seems to be about £140m – just about 10% of the auction proceeds.

Perhaps the government could invest more of its bonanza to help kick-start 5G?

Massive MIMO antenna technology now seems ready for the main stream.

Some hope the additional capacity they create – together with lighting up new spectrum – wards off the need for densification and small cells. Yes, these antennas are clearly helpful – but they don’t buy us much time. Usage is still growing at over 40% a year.

What’s also very clear – is not all towers and cell sites will be able to – or be allowed to – use these larger and heavier antenna structures. Less than 20% of macros in dense urban areas are suitable.

So, what about Dark Fibre? Specifically, Openreach Dark Fibre Access (DFA)?

This time last year, it looked like it would be a godsend. A DFA launch was just around the corner – or so we thought.

We even had a product specification and potential pricing structures.

Even though Openreach is the UK’s biggest fibre owner – they’ve given a virtuoso performance in how ‘not to sell dark fibre.’

Ofcom lost a court case to BT Openreach – and 6 months later – DFA 2 arrived. A massively watered-down dark fibre product.

The heart of Openreach’s legal victory was proving they didn’t have market power in circuits above 1Gb/s speeds.

So, strangely enough, DFA 2 was limited to speeds of 1Gb/s and below. Yes, that’s right. Dark Fibre was limited to 1Gb! Terrific!

Up to that time, I thought dark meant dark – and you could do what you like with it. But no. It doesn’t and you can’t.

It’s all history now. But let’s hope Ofcom return to the pitch – with restored strength – in time for the next business connectivity market review (BCMR) – in 2019.

Naturally, Openreach’s fibre competitors supported the move against DFA 2, – to keep fibre prices at economic levels for them – and to make sure Full Fibre investment goes ahead.

This keeps the incumbents – as the only possible UK suppliers of Dark Fibre – for a bit longer, at least.

We’ve simply got to break out of this stalemate with BT – and create a scale ‘independent’ Dark Fibre Market in the UK – and damn fast.

Openreach’s last act in its scuffle with Ofcom was to cut its 10G Ethernet price. This is helpful for the mobile operators – offering a seductive upgrade from the dominant 1G and 100M EAD backhaul circuits – in place today.

But, it does nothing for densification – and nothing for 5G.

A magnificent move by Openreach – to protect market share and their overall margin-take from the market. You couldn’t say Openreach are fervent evangelists of dark fibre, could you? But who can blame them?

Good news – we have a solution

Last year, I said there was an alternative to Openreach DFA.

We’ve made a big leap forward in understanding the economics and practicalities of creating a true alternative to Openreach.

It’s based on delivering “Mobile-Centric” Fibre networks – to get us in the race for 5G – and to catch up with the leaders in the US and Asia.

What is ‘Mobile-Centric’ Fibre?

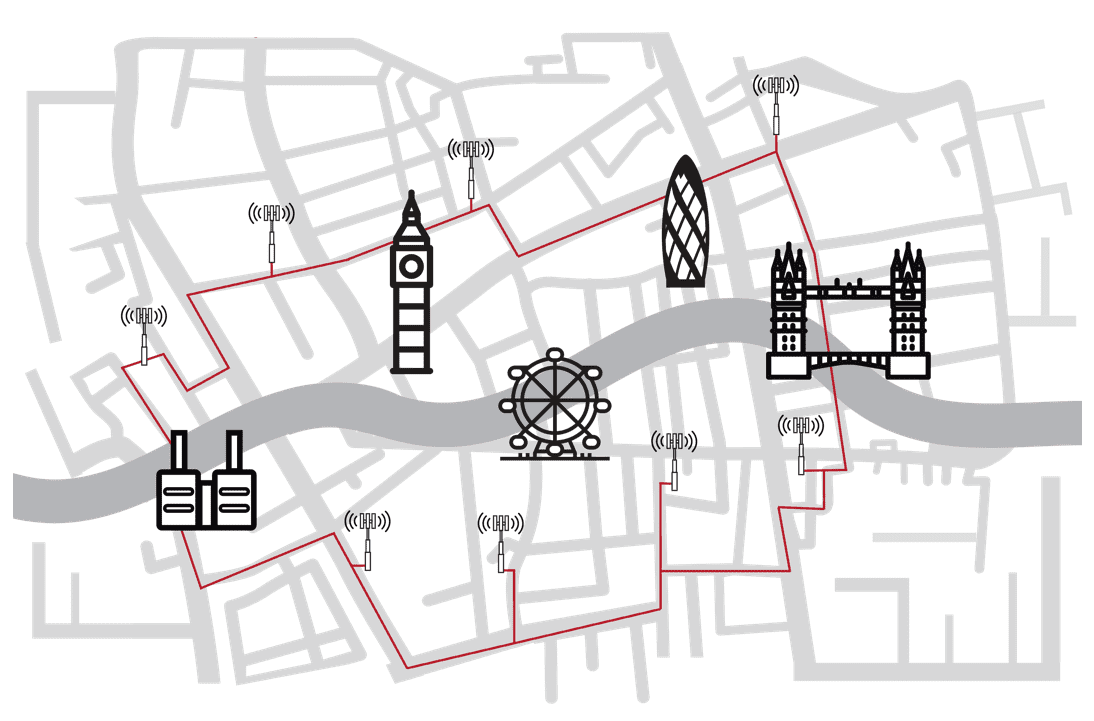

I’m talking about a fibre network – focussed on the priority areas for 4G and 5G densification. And London, is the most burning and complex area over the next few years.

Our design gets us to within a 10m dig of the priority small cell locations for the MNOs. It’s different to the “Full Fibre” networks that target residential and business customers with broadband connections.

Our design gets us to within a 10m dig of the priority small cell locations for the MNOs. It’s different to the “Full Fibre” networks that target residential and business customers with broadband connections.

A Full Fibre focus won’t cover very important mobile areas early enough. But, oddly enough, a ‘Mobile-Centric’ approach could accelerate Full Fibre in the mobile priority areas.

It’s worth reminding ourselves that – in less than 5 years from now – it won’t be realistic to run 5G networks – using standard BT EAD/LA lit services over a hub-and-spoke architecture.

Remember, this architecture was designed at least 100 years ago for analogue telephony over copper wires.

It wasn’t designed for 5G.

Operators of heavily densified networks won’t be able to afford the BT EAD/LA Lit services – never mind live with the constraints on their developing RAN architectures.

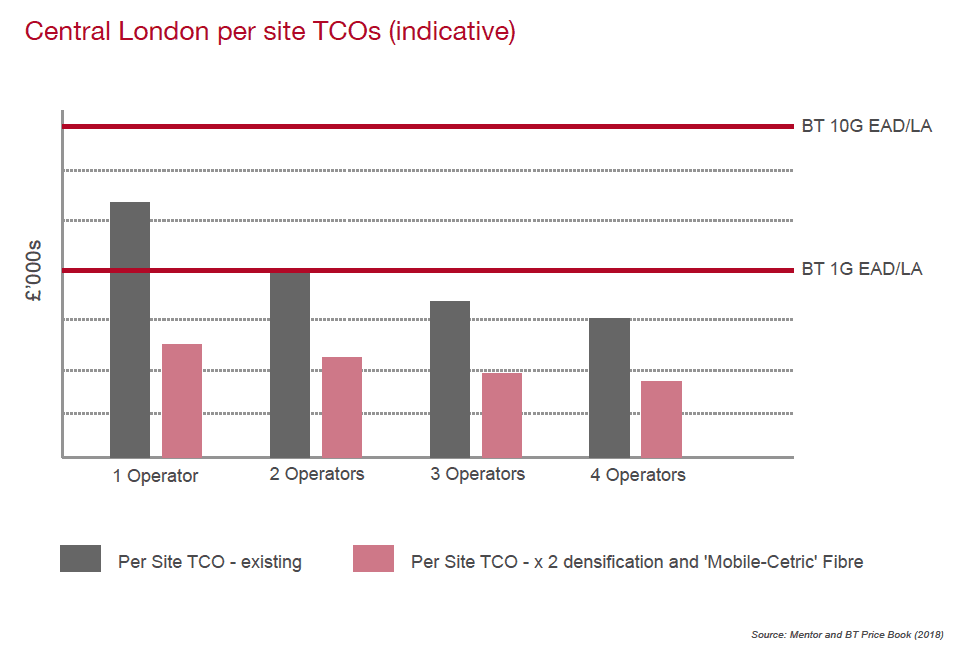

Our target ‘all-in’ price for a small cell’s support infrastructure, including backhaul, is below £1.5k per year.

Bear in mind, BT 1G EAD costs c£2k per year – and 10G EAD/LA c£4k per year – and that’s for an un-resilient service. If you want resilience, double these charges.

And we know future price declines in 10G/1G services will be offset by a need to move to 100G/10G.

It’s little wonder that small cell rollout has stalled.

At this rate, we’ll never break through. Customers – and our place in the 5G race – are the losers.

But it’s not just about the price.

Using a generic ‘lit’ solution – and a hub-and-spoke set-up – is an inherently inefficient – and inflexible architecture. Especially, where Macro-Micro interworking – (that’s so vital for aggregation, integration, and evolution) – must be routed through the serving exchange.

And there are few opportunities to be imaginative at the optical level. It also creates timing and synchronisation challenges, especially for TDD spectrum and awkward CRAN implementations.

Both demand very low latency and very high bandwidth.

Even if the Small Cell Forum and FCC forecasts of up to 350 Small Cells per square kilometre are over optimistic – lower deployment levels – of say 50 to 100 per square kilometre – will require huge densification in the next few years.

And this will trash the economics of an EAD constrained architecture.

Mentor’s “Mobile-Centric” Fibre design relies on three key principles:

First – deploying very high capacity – high strand-count dark fibre rings and ducts – where mobile operators are eager to build more capacity by densification.

Second – the network build uses a ‘mixed economy approach’ – blending the use of Fibre in Sewers – purchase of IRU’s for existing Fibre – and traditional dig – to build rings close to the MNOs preferred locations for small cells.

Third – ring planning takes us to within a 10m dig of key small cell sites – and allows for simple, low cost – almost-on-demand – fibre provisioning that mobile operators urgently need.

(We have the data – we know where these areas are – and how to get fibre to them).

The ring architecture allows flexible connectivity to BT exchanges – independent data centres – existing macros sites – in-building schemes and probable small cell sites.

It naturally provides resilience – through alternate clockwise and anti-clockwise routings – as well as direct connections – to simplify peer-to-peer connectivity within 5G RAN systems.

Explore our 5G services at Mentor Europe.

The Business Case for ‘Mobile-Centric’ Fibre

But, a design without a business case is just an exercise in make-believe.

We’ve built the business case – and we can show it’s sound – both practically and commercially.

In truth it’s a “Shovel Ready” engineering programme – just waiting to execute.

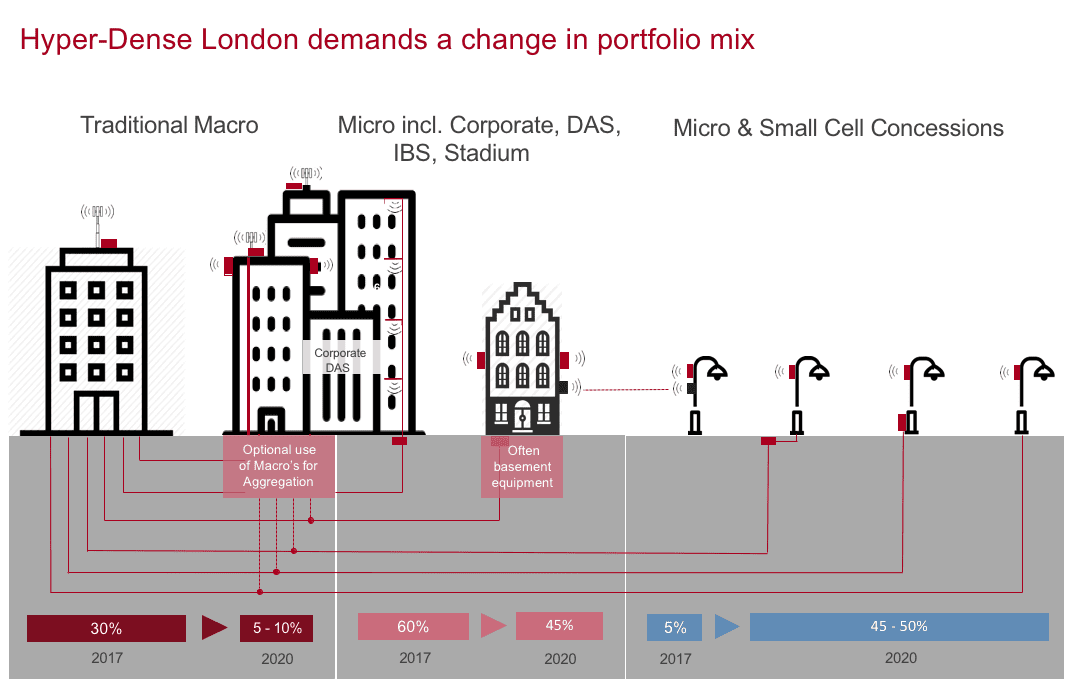

So, we know the switch from EAD/LA will be triggered by a combination of aggregated Mobile Operator densification demand – and economies of scope.

In Dense Urban areas today, the business case for a single Operator to build its own fibre network to its existing sites – is borderline.

(There are no savings on a 20-year BT EAD/LA TCO).

In Dense Urban areas, with two Operators aggregating demand – and driving moderate densification – say x 2. The total cost of ownership (TCO) for the self-build approach is 50% of the EAD TCO – with small cells getting to our ‘all-in’ target of below £1.5k per year Opex range.

That’s with all the infrastructure needed – fibre, plus cabinet and concession rental. Adding a third and fourth operator reduces the per-site TCO by a further 20%.

Our design also delivers lots of spare capacity – allowing fibre wholesaling to Residential and Enterprise-focused ISPs – and super-charging the business case.

But, let me come back to that point in a moment.

Outside Dense Urban areas, the cost-per-metre of deployment drops – but so does site density – and the pace and urgency of densification. And to make a truly powerful business case, economies of scope are particularly important here.

Could ‘Full Fibre’ help?

Full Fibre broadband is the obvious ‘neighbouring’ opportunity.

Sharon White says BT Openreach must replace its “Victorian-era copper network” – with a modern full fibre broadband alternative – or risk losing vast numbers of customers to rivals. “Fibre up or Fade away” was her pointed advice.

And who can disagree?

We’ve seen lots of announcements on Full Fibre – including Vodafone/City Fibres’ – and BT’s own scheme.

And in the last year, we’ve become more enthusiastic about the PIA product. On the surface, it’s appealing.

Why? The cost of building fibre networks has little to do with optical engineering – and everything to do with civil engineering.

But, the good news is, in order to use PIA, you have to deploy fibre. No ‘if’s’ – no ‘but’s’ – no ‘maybe’s’. You’ve got to DO it!

There are some problems though.

First, its scope is currently limited to “primarily full fibre” network construction. That doesn’t help us with our focus on ‘Mobile-Centric” Fibre.

But given the DFA fiasco, why not turn PIA into a Universal Remedy to weaken BT’s local access supremacy? And make it available to all network builders – whether Broadband, Mobile or Convergence focussed?

Second, the draft rules say if the ducts are full, the ISP has to pay to dig a new route – bypassing the congestion. That’s not good – and may rule it out for areas with the most pressing demand – and the most heavily used ducts.

Finally, the rules also say that if the ducts are in poor condition, BT must fix them.

There is an allowance in the price for some repair work for each order placed. But once that’s exceeded the ISP has to fund the balance of the repair cost.

We’re interested to hear from anyone using the service. What’s the practical experience of PIA on the ground? Is it a dream or a nightmare? Anecdotal evidence suggests it’s a nightmare in parts of central London.

Ofcom has rattled its “BT-splitting sabre” several times already.

But I wonder if – with PIA/Duct and Pole – we may finally have a focus for Openreach?

If they could do it really well – and not give preference to their own copper or fibre products. If they could provide a truly even-handed – but upmarket – service for everyone. Then the debates about Openreach’s future could end.

We could all have access to the Ducts and Poles that give BT so much market power today.

And we can each make the call between investing in our own fibre – or buying from someone else – including Openreach.

Now, I’m not a competition law expert, but this has to be worth looking at.

So just what has PIA/Duct and Pole to do with “Mobile-Centric” Fibre?

Well, PIA won’t help with the Fibre rings. We are not expecting it.

For the Mobile Priority areas, we believe BT’s ducts are jam-packed with cables – and we would end up digging round half of London.

Where we are interested is – if it can help deliver one of the economies of scope – for our “Mobile-Centric” Fibre.

Instead of the last mile, we think we can just use the last ¼ mile of BT’s Duct and Pole network – to deliver fibres from our rings – down the streets – to pass the many homes and businesses in these areas.

Fixed Wireless Access is well worth looking at too.

We’ve said we’ll have lots of spare ring fibre. So, whether as a direct offering – or more likely partnering with leading Broadband players – this is a significant scope economy for our core ring build. And a significant opportunity to supercharge UK full fibre.

We are confident a cost per Full Fibre home passed of £250 is realistic – using this approach. Radically cheaper than traditional dig or BT EAD based solutions.

Dark Fibre: pulling the threads together

So, are we really in the race for 5G? Not yet.

- Not because UK Research isn’t focused on 5G – because it is!

- Not because UK Mobile customers aren’t big users – we are!

- Not because Operators aren’t inventive – they are!

- Not because UK Spectrum is locked away or out of commission – it isn’t!

But – because we don’t have widespread dark fibre provided by ‘raring-to-go’ suppliers.

It’s not rocket science – but it is management science.

We know where the operators need fibre to drive their densification plans – down to the individual site grid references.

We know how to build that fibre quickly – and how to break free from BT EAD constraints – and bring a legion of architectural benefits as well.

We can demonstrate real savings – if we work together – and generate positive returns on the investments.

We even know how to supercharge Full Fibre – in the same neighbourhoods – by using the last ¼ mile of BT’s Ducts – or FWA.

So, the opportunity is there. It’s massive. And the time is now.

‘I heard a story about a man who visited a Greek monastery – that was perched high up on a steep mountain. The only way to get there was in a rope basket.

He got into the rope basket – and was just about to be taken up the steep cliff – when he noticed the rope lifting the basket was threadbare – and beginning to unravel.

He asked the monk ’How often is the rope replaced?’ The monk said ‘every time it breaks.’

That’s the attitude of the incumbents to the UK’s dark fibre problem.

I say . . . let’s replace the rope – before it breaks – and show some leadership in cracking the problem.’

We didn’t do it in the last 12 months. But ‘so what!’

Let’s work together now – get experienced groups together to do it – and get the UK back into the race.

The alternative is not worth thinking about.

Thank you.

Why don’t you schedule some time with us now for an individual chat? You’ve got nothing to lose!

Email us at enquiries@mentoEeurope.com